In June 2024, the Greater Toronto Area (GTA) experienced a notable shift in its real estate landscape.

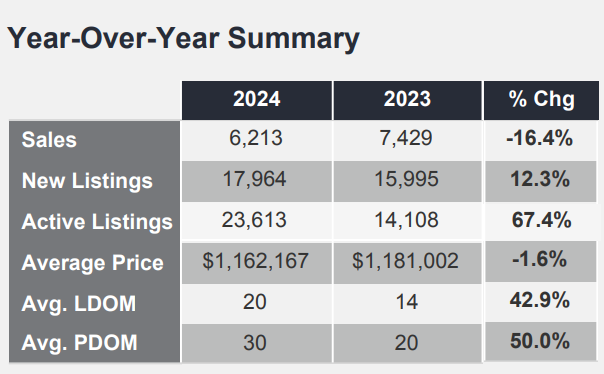

Despite the Bank of Canada's recent rate cut aimed at stimulating the market, home sales dropped by 16.4% compared to the same time last year.

The Toronto Regional Real Estate Board (TRREB) reported 6,213 sales, down from 7,429 in June 2023, reflecting a cautious market atmosphere as buyers remain hesitant.

New listings surged by 12.3% to 17,964, providing a wealth of options for prospective buyers however despite this increased supply, the average selling price only dipped slightly by 1.6% to $1,162,167.

This combination of decreased sales and increased listings suggests a market in transition, presenting unique opportunities and challenges for both buyers and sellers.

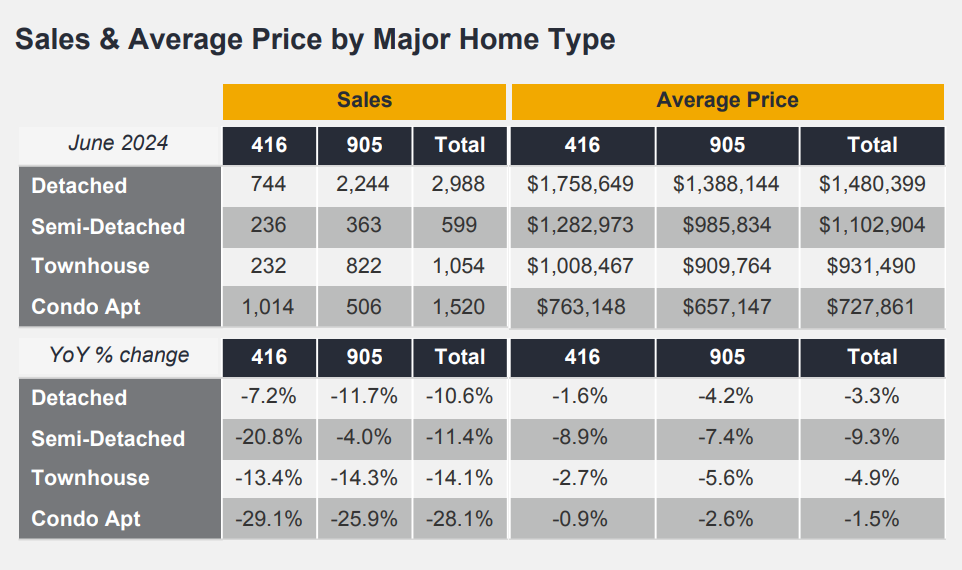

Sales and Average Prices by Home Type

- Detached Homes:

- Sales: 2,988 (416: 744, 905: 2,244)

- Average Price: $1,480,399 (416: $1,758,649, 905: $1,388,144)

- YoY Sales Change: -10.6% (416: -7.2%, 905: -11.7%)

- YoY Price Change: -3.3% (416: -1.6%, 905: -4.2%)

- Semi-Detached Homes:

- Sales: 599 (416: 236, 905: 363)

- Average Price: $1,102,904 (416: $1,282,973, 905: $985,834)

- YoY Sales Change: -11.4% (416: -20.8%, 905: -4.0%)

- YoY Price Change: -9.3% (416: -8.9%, 905: -7.4%)

- Townhouses:

- Sales: 1,054 (416: 232, 905: 822)

- Average Price: $931,490 (416: $1,008,467, 905: $909,764)

- YoY Sales Change: -14.1% (416: -13.4%, 905: -14.3%)

- YoY Price Change: -4.9% (416: -2.7%, 905: -5.6%)

- Condo Apartments:

- Sales: 1,520 (416: 1,014, 905: 506)

- Average Price: $727,861 (416: $763,148, 905: $657,147)

- YoY Sales Change: -28.1% (416: -29.1%, 905: -25.9%)

- YoY Price Change: -1.5% (416: -0.9%, 905: -2.6%)

Year-Over-Year Summary

- Total Sales: 6,213 (2024) vs. 7,429 (2023), a decrease of 16.4%

- New Listings: 17,964 (2024) vs. 15,995 (2023), an increase of 12.3%

- Active Listings: 23,613 (2024) vs. 14,108 (2023), an increase of 67.4%

- Average Price: $1,162,167 (2024) vs. $1,181,002 (2023), a decrease of 1.6%

- Average LDOM: 20 (2024) vs. 14 (2023), an increase of 42.9%

- Average PDOM: 30 (2024) vs. 20 (2023), an increase of 50.0%

Market Insights

- Buyer Hesitation: Despite rate cuts, the 16.4% decline in sales suggests buyers are waiting for more significant reductions or economic stability. This cautious approach indicates that confidence in the market is yet to be fully restored, and further monetary easing might be necessary.

- Increased Supply: New and active listings have risen significantly, providing buyers with more options and greater negotiating power. This abundance of choices can lead to more balanced and stable pricing in the short term, preventing sharp price increases.

- Price Discrepancies: The average price for detached homes in Toronto (416) remains significantly higher than in the GTA (905), with Toronto seeing smaller price declines compared to the broader GTA. This trend highlights the continued strong demand for urban living and limited supply in the city core versus the suburbs.

- Longer Time on Market: The increase in average Listing Days on Market (LDOM) and Property Days on Market (PDOM) suggests that properties are taking longer to sell. Sellers need to adopt more strategic pricing and marketing approaches to attract cautious buyers.

- Future Outlook: The market is poised for potential recovery as borrowing costs decrease further and economic conditions stabilize. With a well-supplied market, buyers have the upper hand for now. However, sellers can still benefit from the strong long-term demand driven by population growth and urban development goals. For investors and homebuyers, this period offers a strategic window to capitalize on increased inventory and favourable negotiating conditions.

Summary

The current market conditions highlight the importance of strategic pricing and marketing for sellers and diligent market research and negotiation for buyers.

Sellers should be prepared to adjust their expectations and pricing strategies to align with the current market dynamics.

Buyers, on the other hand, can take advantage of the increased supply and negotiate better deals.

Looking ahead, the market is expected to rebound as economic stability returns and borrowing costs decrease.

For investors and homebuyers, staying informed and ready to act will be crucial in making the most of the opportunities that arise as the market adjusts.

The long-term outlook remains positive, with population growth and government efforts to support housing development ensuring sustained demand in the GTA real estate market.

Have any questions about the current state of real estate in Toronto?

Feel free to reach on Instagram @TorontoRealEstate.ca !

Rylie C.

Source

https://trreb.ca/wp-content/files/market-stats/market-watch/mw2406.pdf

Comments